stock option exercise tax calculator

What You Can Expect - 943 Get a sense of what you should and should not expect in the terms of your stock option grant. Vega for this option might be 003.

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

You exercise your option to purchase the shares and you hold onto the shares.

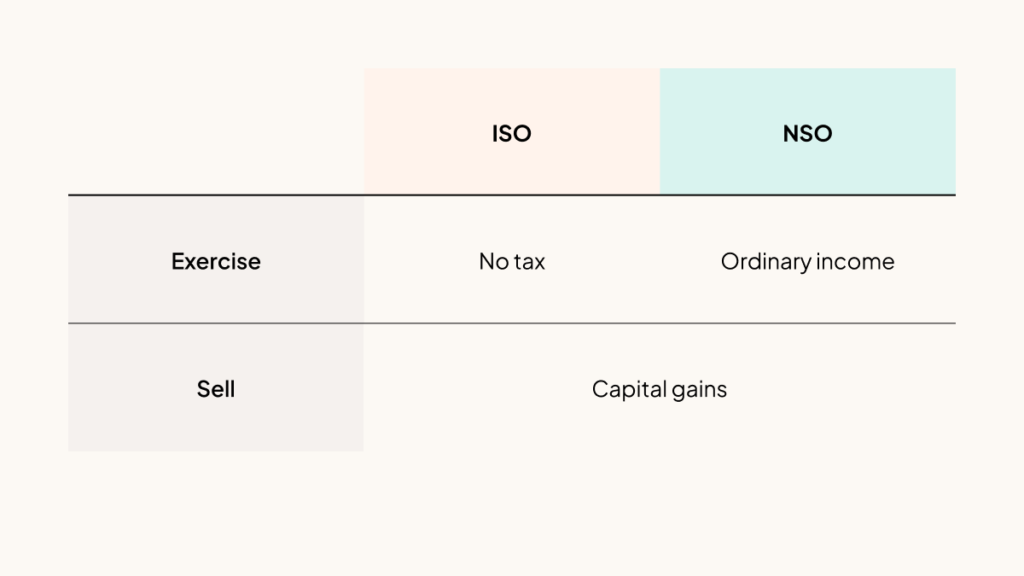

. An NSO gives option holders such as employees or independent advisors the opportunity to purchase a companys stock at a given price known as the exercise price or strike price. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Stock Option Exit Calculator. Taxed as regular income. Taxes Due at Exercise.

No 2 ways about it. What is the impact of increasing my 401k contribution. My taxable income should only be 4000 which will already be reflected in my W-2.

1 online tax filing solution for self-employed. If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference. The Employee Stock Option Fund provides current and former employees of venture-backed companies with the cash needed to exercise their options and cover associated taxes.

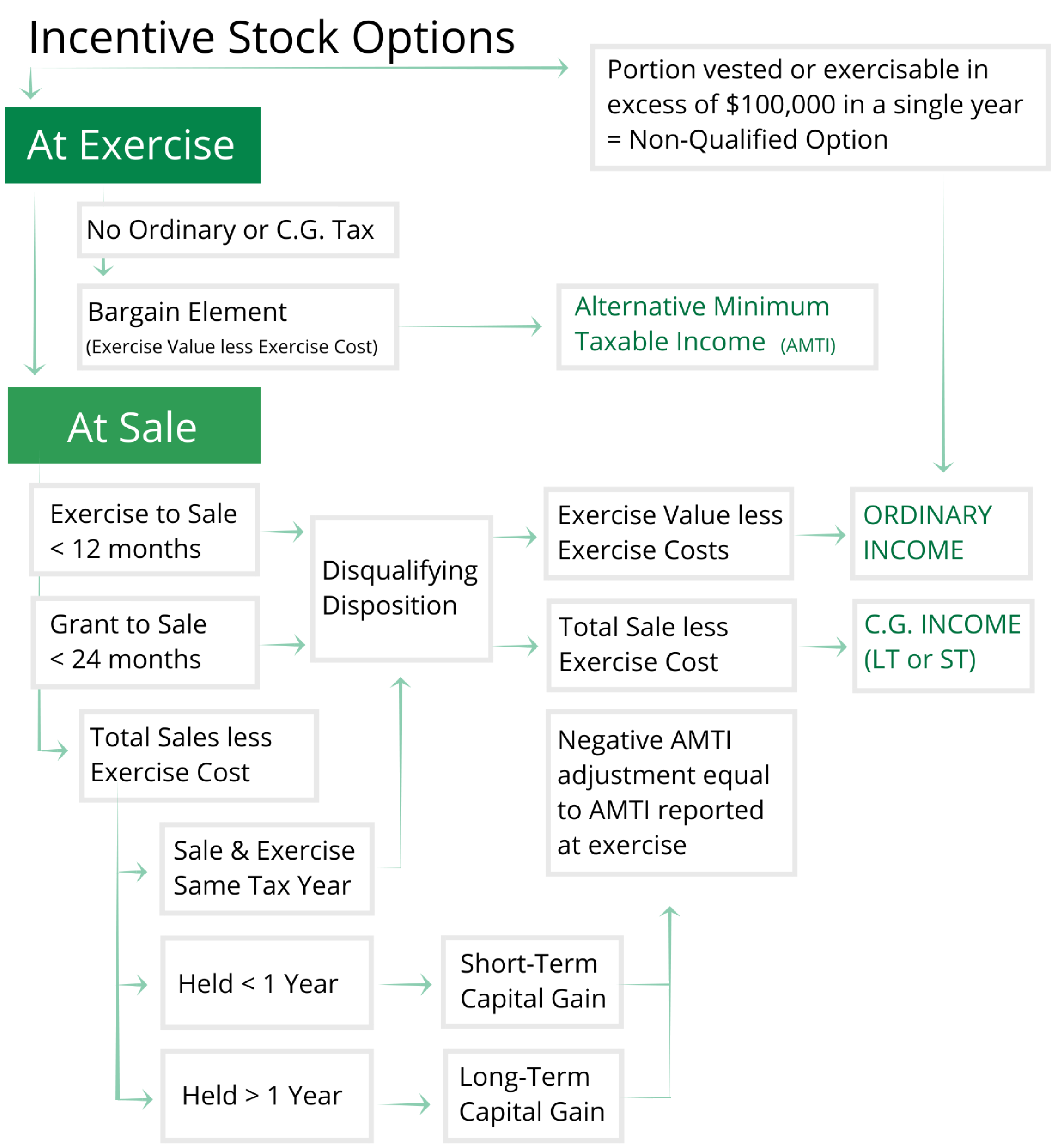

The advantage of an ISO is you do not have to report income when you receive a stock option grant or when you exercise that option. What may my 401k be worth. The stocks basis is the total of both.

Must pay the difference between the stocks market value and the exercise price. For example if a stock currently trades at 40 and an. Subtract the amount paid for the stock option price.

WRONG If you buy an option on a stock that is currently at 100 and you pay 100 for the option and the stock drops to 0 then the most you can possible ever ever lose is your 100. And depending on how long you own the stock that income could be taxed at capital gain rates ranging from 0 to 238 for sales in 2021typically a. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and the current fair market value.

Exercising your non-qualified stock options triggers a tax. Self-Employed defined as a return with a Schedule CC-EZ tax form. The most significant implication for employees is a 25000 benefit.

The ESO Fund does not provide legal financial or tax advice. For example a 30-day option on stock ABC with a 40 strike price and the stock exactly at 40. Its included in box 1 of Form W-2 is the spread between the stocks fair market value when you exercised the option and the exercise price.

ISO tax treatment and benefits. What is the value of a call or. The interview is a companion to Mr.

Two types of stock option taxes to keep in mind. Ideally the market will rise above the exercise price by the time the employee or other stakeholder exercises the options purchases the shares. Options are purchased by investors when they expect the price of a stock to go up or down depending on the option type.

When an employee exercises the option of buying shares the difference between the market value of the shares and the exercise value of the share will be taxable according to the tax bracket the employee falls under. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. Exercise incentive stock options without paying the alternative minimum tax.

How you report your stock option transactions depends on the type of transaction. Multiply the fair market value per share box 4 by the number of shares sold often the same amount in box 5 to find this. Report the amount of ordinary gain as wages on Form 1040 Line 7.

The ordinary income might be more than the gain on the sale. Difference between the stocks market value and the exercise price could trigger the alternative minimum tax AMT. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

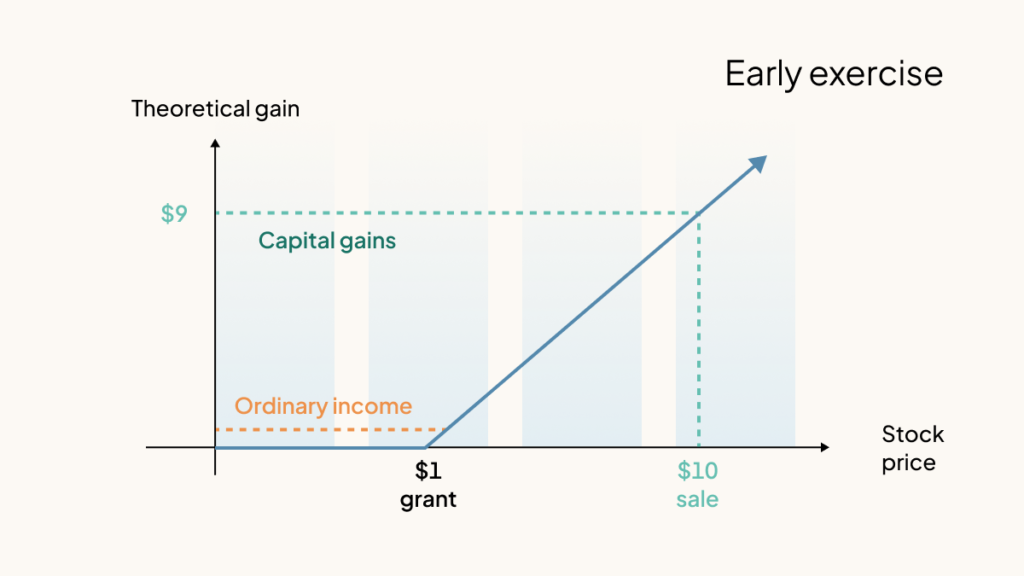

Monday February 15 2021 Due date for filing of return of income for the assessment year 2020-21 if the assessee is a corporate-assessee or b non-corporate assessee whose books of account are required to be audited or c partner of a firm whose accounts are required to be audited or d required to submit a report under section 92E pertaining to international or. Since the stock price starts at 5 on the date of grant and then rises to 8 a share at the time of exercise theres an embedded gain of 3 per NSO. Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment.

So if you have 100 shares youll spend 2000 but receive a value of 3000. You report the taxable income only when you sell the stock. Should I adjust my payroll withholdings.

Here we explore what it means to exercise stock options how stock options are taxed and the common times people exercise their options. Should I exercise my in-the-money stock options. Taxes for Non-Qualified Stock Options.

Determine the FMV of the stock on the date you received it exercise date. In this interview compensation expert Richard Friedman Ayco Company discusses trends in vesting schedules post-termination exercise rules and other plan features. Free startup equity calculator Employee Shareholder Bill of Rights.

Friedmans article on this topic. That means youve made 10 per share. Do not have to pay taxes on the exercise date.

Finding the 1010 Perfect Cheap Paper Writing Services. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. 635 Mariners Island Blvd.

Americas 1 tax preparation provider. In other words the value of the option might go up 003 if implied volatility increases one point and the value of the option might go down 003 if implied volatility decreases one point. Contact 1 650 262-6670.

Using the ESPP Tax and Return Calculator. 9 Promises from a Badass Essay Writing Service. You exercise your option to purchase the shares and then you sell the shares the same day.

Fund your option exercise. As I typed this out it became more clear in that the FMV of the stock option exercise event was 4000 and I received that in cash of 3000 4000 less 1000 wht and in withholding tax credit of 1000. In that situation the lowest a stock price can go is 0 so the most you can lose is the amount you purchased it for.

Stock Options. This means that for each option you exercise you would recognize 3 of ordinary income and youd owe taxes on that income even if you dont sell anything. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

As Close to 100 As You Will Ever Be. Calculate the costs to exercise your stock options - including taxes. See what your stock options could be worth.

Usually taxable Non-qualified Stock Option transactions fall into four possible categories. Decide whether to exercise your stock options now or later. Your 1 Best Option for Custom Assignment Service and Extras.

Stock Option Tax Calculator. 2022 federal income tax calculator. Professional Case Study Writing Help.

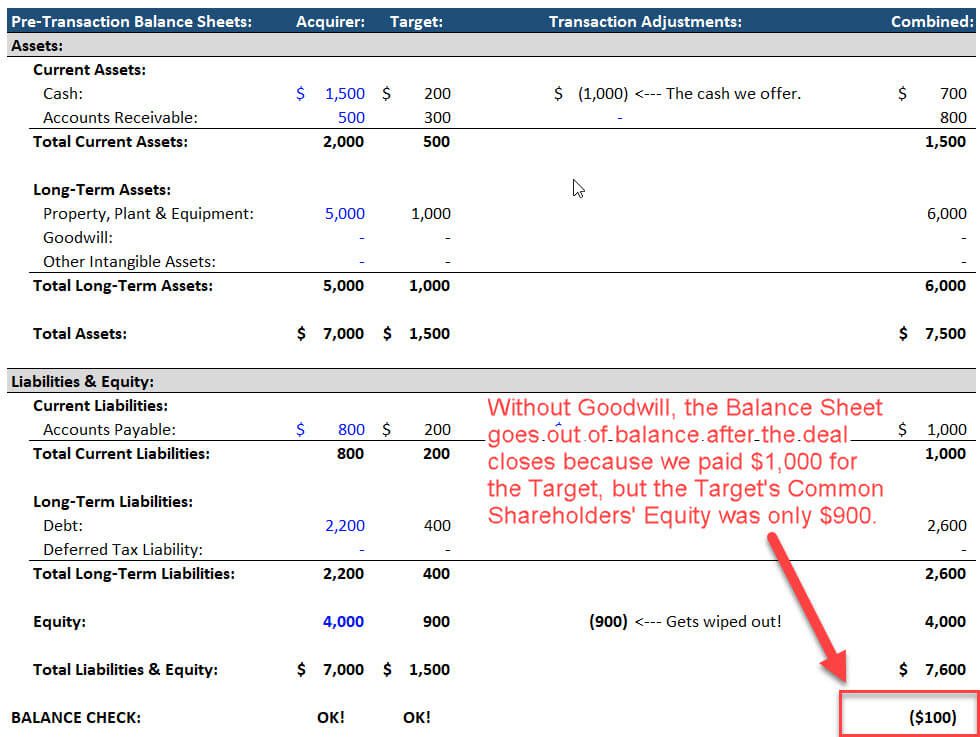

How To Calculate Goodwill Video Tutorial Examples And Excel Files

How Stock Options Are Taxed Carta

Do You Want A Fair Forensic Accounting Of Annual Report So That Errors And Inte Small Business Accounting Business Valuation Small Business Accounting Software

Secfi Alternative Minimum Tax Calculator

Option Exercise Calculator Liquid Stock

Tax Planning For Stock Options

Call Option Calculator Put Option

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

Option Exercise Calculator Liquid Stock

Employee Stock Options Financial Edge

Treasury Stock Method Tsm Formula And Calculator Excel Template

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

When Should You Exercise Your Nonqualified Stock Options